Strategy Analysis: External & Internal Environment (Part 2)

This post is part two of a mini-series on strategic management. Check out post one here.

Similar to sleep, or health and fitness, there are specific tools and protocols we can follow when it comes to business strategy. Strategy analysis is the first stage of strategic management. Strategy is the science and practice of setting organizational decisions based on evidence, data, and existing environmental constraints. Strategy analysis is the first milestone of strategic management, which is also composed of strategy formulation, portfolio planning, growth choices, strategy implementation. Strategy analysis is the data collection stage of the process. To bring clarity into chaos, there are some specific tools you can use to analyze the external and internal environments. It is pivotal to differentiate between those two categories. External analysis refers to the study of the environment surrounding the organization, its competitors, suppliers, overall macro environment, and trends. Internal analysis is the study of the organization itself. Both are necessary to determine the starting point of effective strategic management. You need to "know thyself" to double down on your strengths and improve your weaknesses. You need to be aware of the environment around you so that you can develop resilience, awareness, and ultimately a competitive advantage.

This last point is worth exploring more deeply. The ultimate objective (or finding) of a strategic analysis is competitive advantage. What is it that differentiates your business/yourself from competitors? Why should a customer choose you and not your competitors? Such questions may feel uncomfortable and difficult to answer. Why compare yourself to others? Competitive analysis is only a tool to raise awareness of your surroundings. Its aim is not to "compare yourself to others" in an unproductive way. Business is an infinite game.

External Environment

The external environment is composed of all the players around your business. These are suppliers, customers, competitors, trends affecting your industry, macro and microeconomic variables. The two most relevant tools you can use to analyze the external environment are Pestle Analysis (macro environment), and Porter's 5 Forces (Porter, 1979) for industry analysis. Your macroenvironment is composed of all the economic, social, and industrial forces shaping your daily activities and business at large. The industry you are part of corresponds to the market you operate in, composed of all the companies in that industry.

PESTLE Analysis

PESTLE analysis is a macro-environment tool for organizations to research and understand the external macroenvironment. Every factor of PESTLE influences your business in some shape or form. Overlooking such understanding can be dangerous because awareness of the "game" you are playing is fundamental in order to make the most effective choices. When conducting a PESTLE analysis, you dive into each of this framework's components and understand how they affect your organization:

Political factors → How are political decisions shaping the game you are playing?

Economic factors → What are current (and predictable) economic trends that influence your business?

Social factors → How are society's needs shifting? Which are the most relevant social factors influencing your business?

Technological factors → What is the role of technology in your business? What is the current state of technology and how does it affect your organization?

Legal factors → Which laws and regulations restrict/enable you to operate most effectively?

Environmental factors → What is the impact of the environment on your organization? And what's your organization's impact on the environment?

Porter's 5 Forces

While PESTLE analysis is the first tool to step back and look at the whole external environment, Porter's 5 Forces focuses on industry analysis. Particularly, this framework determines the attractiveness of an industry (its likelihood of being profitable and prosperous over time). As the name implies, Porter's 5 forces utilize five dimensions to determine an industry's attractiveness. Each dimension can score "high" or "low" in a continuum.

Rivalry → The level of competition in your industry

Bargaining Power of Suppliers → The degree to which suppliers in your industry can influence prices. Generally, the fewer suppliers are there, the higher their power to influence prices

Bargaining Power of Buyers → The degree to which buyers (customers) can influence prices

Threat of New Entrants → The degree to which it is easy for a new company to enter the industry

Threat of Substitutes → The degree to which it is easy for customers to switch among products/competitors in the industry. The least differentiated your offering, the more likely your customers may be willing to switch.

If we look at the fitness industry, here is how Porter's 5 Forces analysis would be conducted:

Define fitness industry. "Fitness" is a broad term. Fitness may refer to physical gyms, personal training services, home gyms, gym equipment, supplements, nutrition. Porter's 5 forces always starts with a clear definition of the industry we are analyzing.

In our example, we'll define the fitness industry as physical and home gyms

Rivalry: Moderately High. With the fitness industry being on a significant growth trajectory over the past decade, the number of players has been increasing significantly, and the number of competitors in the space is high

Bargaining power of suppliers: Suppliers in the fitness industry as we defined it mainly include equipment-producing companies. We could argue that fitness equipment production follows the 80/20 rule: 20% of producers make 80% of the equipment for "real" and "home" gyms. The most prominent include Technogym, Panatta, Hammer Strength, Life Fitness. So, the bargaining power of suppliers in the fitness industry is moderately high

Bargaining power of buyers: With many gym chains and private studios fiercely competing to attract fitness enthusiasts, the bargaining power of buyers in the fitness industry is moderately high. Buyers can influence the prices by making choices as to which gym to choose

Threat of new entrants: Entering the fitness space is relatively easy. The threat of new entrants is moderately high, although the upfront investment is the main barrier of entry in our example

Threat of substitutes: With technological progress paving its way into the fitness industry, the threat of substitutes has been increasing significantly over the past few years. Physical gyms are threatened by the home gym trend accelerated by the Covid-19 pandemic

Internal Analysis

While looking "outside of you" may be a good strategy to gauge the environment and the state of things, ultimately, every company needs to "know itself." By becoming aware of your own core competencies, competitive advantage, strengths, and weaknesses, you can focus on the elements that bring the most value while improving on your shortcomings. Such an argument runs on a similar line of reasoning as personal improvement. You can improve your company's position in the market. You must "know thyself" in order to do so.

Core competencies

Internal business analysis begins with the clear identification of core competencies. On a practical note, these are the sum of your firm's resources and capabilities. Resources can be tangible (e.g., location, equipment) or intangible (e.g., brand, know-how, technology). Capabilities are the ability to deploy resources through structure, processes, and systems. The sum of resources and capabilities constitutes your core competencies. To distinguish yourself from the competition, your core competencies need to be unique. The degree of uniqueness of your core competencies can be determined using the VRIO framework presented below.

VRIO

VRIO stands for "Valuable," "Rare," "Inimitable," "Organized." If you manage to score high in those four dimensions when dissecting your core competencies, there is a clear competitive advantage. A competitive advantage is a highly unique characteristic that differentiates your offer from other companies in the market. Competitive advantage can stem from specific characteristics that make a company stand out. Amazon's incredibly fast shipping can be considered a competitive advantage of the organization, which can ship products to busy customers faster than competitors. This makes the company's products highly palatable to consumers who value speed of execution (a seemingly widespread raw customer need at the moment of writing).

Valuable means "creating costs or performance advantages."

Your core competence is rare when it is not widely available/accessible to competitors. If you have access to a valued scarce resource but your competitors do not, you have a rare core competence that differentiates you from the competition.

Inimitable refers to the ability of your core competence to not be easily imitated or substituted by competition

Your core competence is organized if the firm has effective and efficient processes and systems to capture value

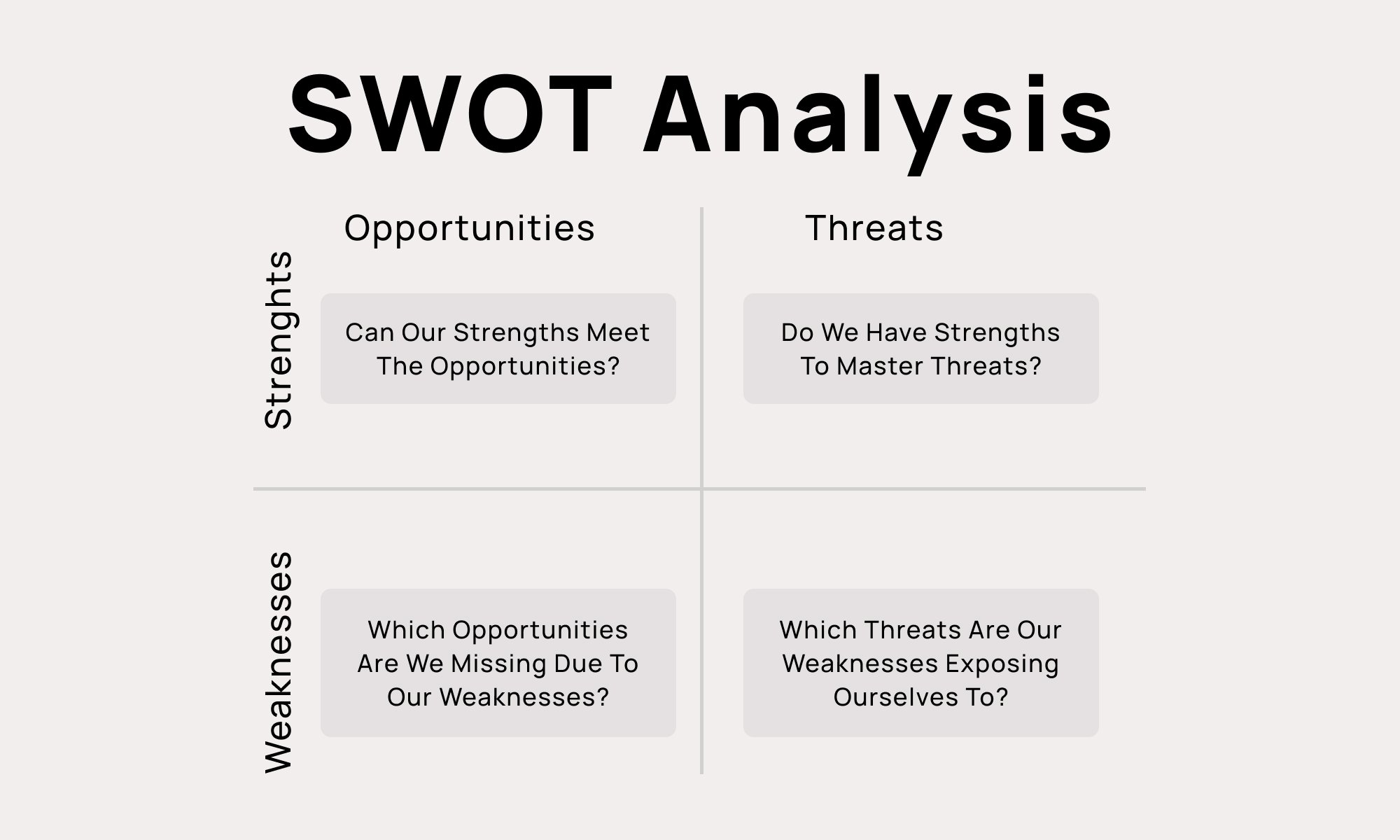

SWOT

SWOT Analysis Grid

The results of external and internal business analysis can be combined in the SWOT analysis. Sometimes, we think of SWOT as a stand-alone tool we can use to figure out our business' internal and external environment. That is not the case. There is value in deferring the use of SWOT during the Strategy analysis process. This tool does not provide the same depth and comprehensiveness the frameworks presented earlier in the post do. The SWOT analysis takes the findings from previous analyses to centralize them in one place. The acronym SWOT stands for "Strengths," "Weaknesses," "Opportunities," "Threats." The first two refer to internal research. Weaknesses and Opportunities are about the external environment.

Due to its "aggregating" nature, the SWOT analysis is often used as a mere "summary" of the findings from the analyses above. That is not an effective way of conducting a SWOT analysis. SWOT must provide answers, rather than a mere summary. SWOT defines the implications and strategic actions needed to elevate your organization to the highest level you envision.

Performing a systematic, appropriate, and comprehensive analysis of your organization can make a difference in the awareness it raises. Using the tools presented above can be a game-changer toward understanding your organization, becoming more aware of "yourself," and devising clear plans of action in the next stage of the process: strategy formulation.

RESOURCES

Strategic Management university course content (not shareable)